Setting the maximum tax rate.

In compliance with what I can only think of as a purposefully confusing Texas state law ironically titled Truth in Taxation the Austin city council sets the maximum tax rate they will consider.

The mayor has pledged to explain setting the maximum tax rate every chance he gets so here he goes again at the July 31st budget work session.

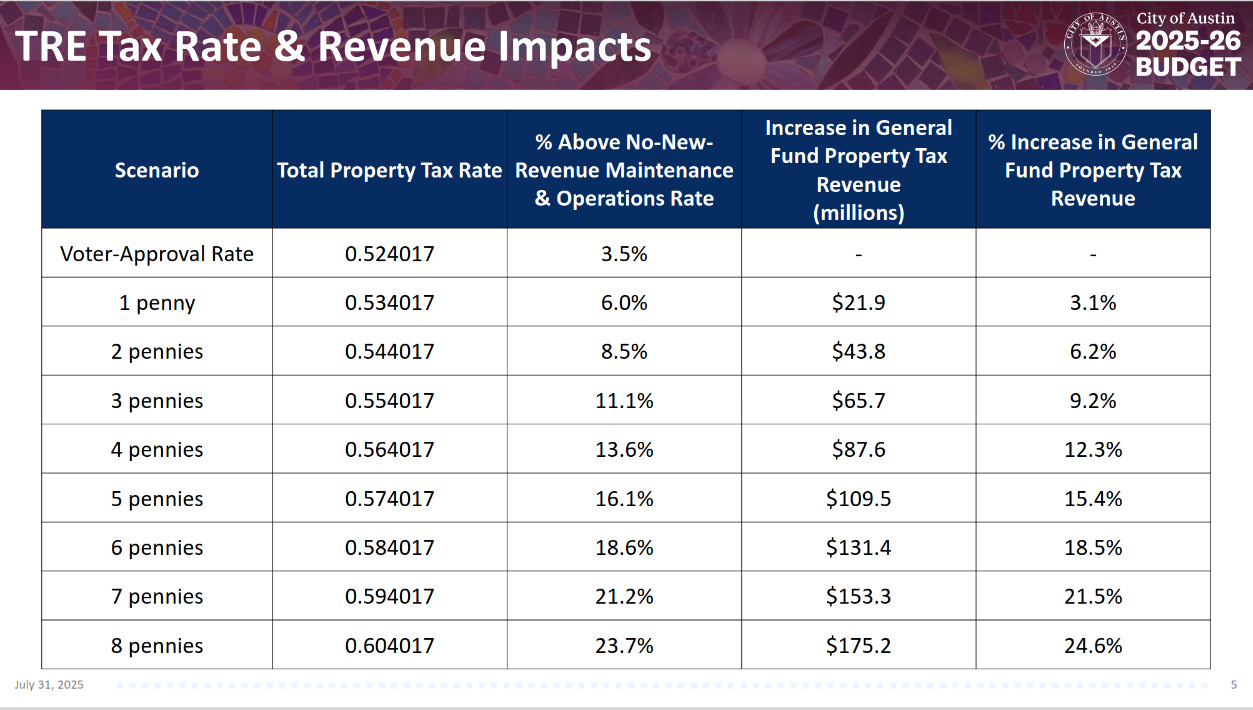

In case you didn’t want to listen to that video segment, the mayor took a motion to set the maximum tax rate that the council will consider on August 13-15 (should it take three days) at $0.604017 per $100 property evaluation and set a public hearing at 10am on August 13th as required by Texas state law to hear from the public one last time before council decides on the actual property tax rate for FY25-26. Note from the last table below that the maximum tax rate considered would include a voter approved tax rate election for an additional $0.08 per $100 property evaluation in addition to the 3.5% Texas statutory maximum rate set by law in 2019 beyond which a voter approved tax rate election is required.

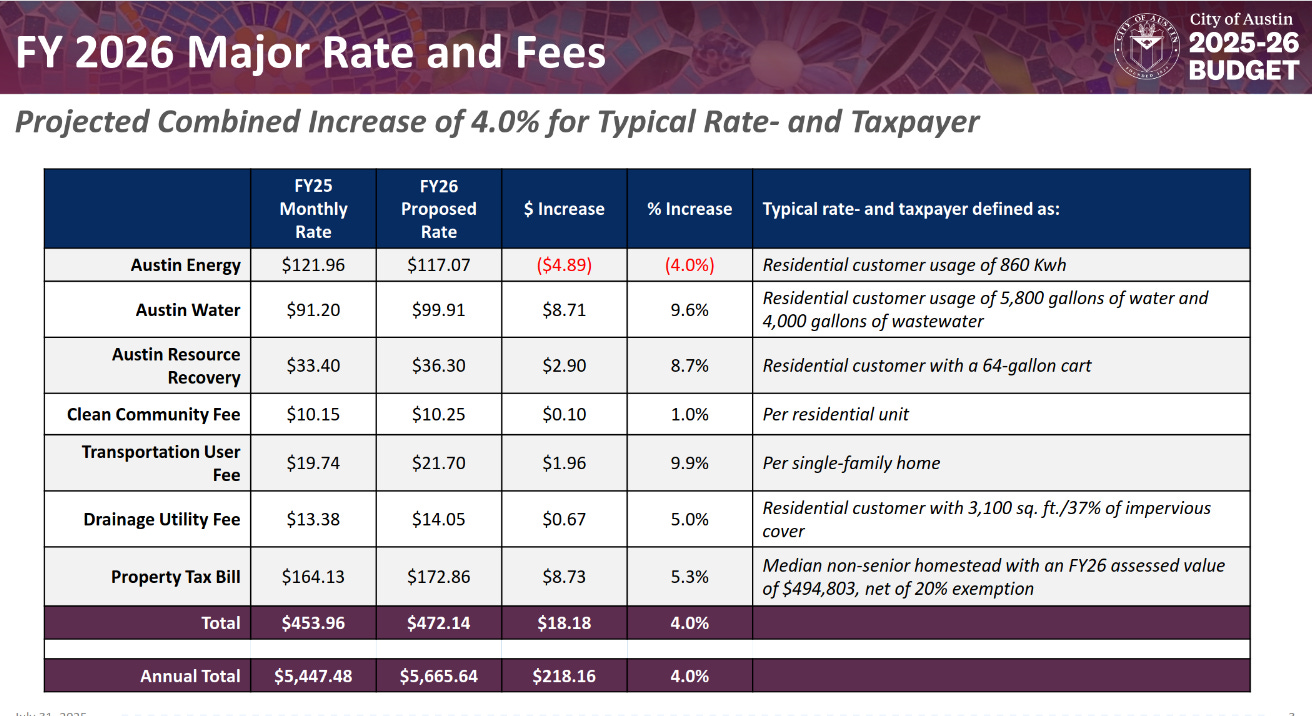

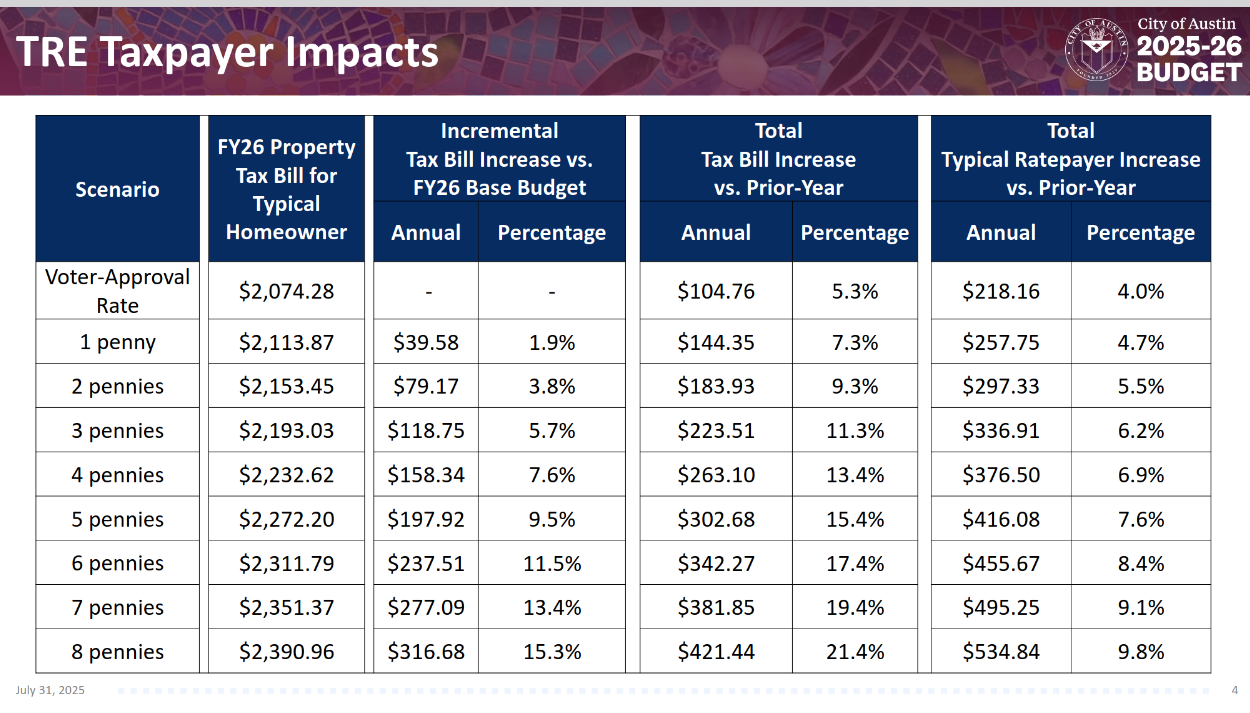

Earlier in the July 31st budget work session Deputy Director Nelson presented two slides similar to those on July 22nd but now more accurate because they are based on the just received certified property tax evaluations from the Travis, Williamson, and Hays County Appraisal Districts.

The 3.5% budget proposed by the city manager and his staff increases the property tax of a median value single family residential property with the Texas homestead exemption, often somewhat erroneously referred to by staff and council members as the typical property for the sake of discussion, by $18.18. A voter approved tax rate election that increases the tax rate by $0.01 per $100 property evaluation yields $39.58 for a total property tax increase of $57.76. And so on up to $0.08.

At the July 29th budget work session the mayor elicited from Director Lang the staff opinion that $0.05 per $100 would be adequate to fund the city’s needs for FY25-26. Since then Council Member Alter has posted to the council message board that $0.05-0.07 would be appropriate funding. Council Member Siegel responded in that same thread saying that $0.07 was required to meet the city’s needs. Council Member Ellis mentioned $0.04 cents per $100 property evaluation at the July 31st budget work session.

Onward to the last slide.

The importance of this slide is that you can use the Total Property Tax Rate column and go look up your certified property evaluation for the city of Austin on the Travis, Williamson, or Hays County Appraisal District (TCAD, WCAD, or HCAD) website with or without a homestead, senior, or disability exemption as the case may be, and estimate your tax bill for the various scenarios. Do note however that this does not include any changes in the “Typical Rates” in the first slide above. The council may vote in favor of a new park fee for example or increasing the drainage fee and spending the increase on parks. The council as a whole does not seem to be too thrilled with the idea of raising money by selling naming rights to various park department properties.

Also from the July 31st budget work session I have included a video segment which unmasks the complexity of the budget process this year. This is often referred to idiomatically as being in the weeds.

Should you decide not to watch this segment Council Member Siegel raises a pertinent question for City Manager Broadnax about how to proceed, the mayor elaborates on the city manager’s answer and the three come to at least the beginnings of a procedure to move forward. Next meeting will be a budget work session on August 7th at 9am followed by an Audit and Finance Committee meeting at 1:30pm. To see what the tentative procedural plan is you will have to watch the segment. You can expect more discussion in the interim on the Council Message Board. Probably the mayor will start the discussion sometime Friday August 1st. The mayor’s Chief of Staff Colleen Pate usually posts in the mayor’s name.

Coda: If you happened to watch the Audit and Finance Committee meeting on July 30th, please be aware that the data presented is erroneous due to mistakes by the Williamson County Appraisal District. Happily I learned of the error before I finished a post about that meeting. If you watch my YouTube channel I have left the video of the meeting there but marked the title and description concerning the error. Kudos to city staff who were told about the erroneous data early on July 31st and still had the correct info ready while the budget work session was ongoing.